Unlocking the Potential of Securespend for Smart Shopping

The Basics of Securespend for Beginners

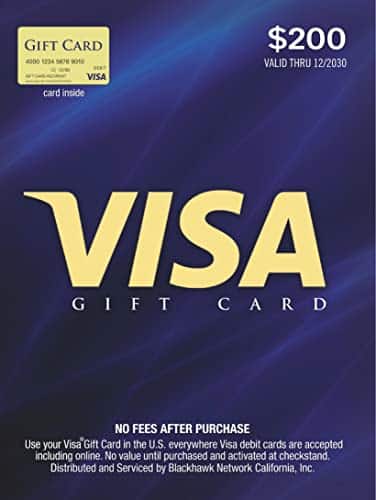

Alright folks, strap in – we’re about to embark on an exciting journey into the world of Securespend. What the heck are Securespend cards, you ask? Imagine a swiss-army knife of savings – that’s Securespend for ya! These nifty little tools are essentially prepaid cards that let you sprinkle savings magic everywhere Visa or Mastercard is accepted.

Here’s the lowdown: scoot over to the back of your card, spot that toll-free number? Give it a buzz to know what’s your balance power. Or, simply hop onto the card issuer’s website, punch in your 16-digit card number and security code, and voilà, you’re in charge of your balance! Obtain ’em at various retailers or order one online – boom, you’re ready to roll. Remember, if your card throws a hissy fit at the cash register, it’s time to play detective with SecureSpend and snag a shiny new one. Just don’t forget that original receipt.

Navigating the Deals: How to Optimize Your Securespend Use

Keep your eyes peeled for jaw-dropping deals and savings opportunities – they’re like cheese on pizza, essential for a good time with Securespend. Timing is everything! Sync your purchases with Securespend promos, and you’ll be racking up savings faster than a squirrel on espresso.

Monitoring Deals and Savings:

Importance of Timing:

SecureSpend accounts software

$0.00

SecureSpend Accounts Software is a comprehensive financial management solution designed for small to medium-sized businesses seeking an intuitive and secure approach to handle their accounts. With its user-friendly interface, businesses can effortlessly manage their income, expenses, and make informed financial decisions. The software offers real-time tracking of cash flow, allowing users to visualize their financial health at a glance and take timely actions to optimize their spending and savings.

Security is a paramount feature of SecureSpend, providing robust encryption and multi-factor authentication to safeguard sensitive financial data against unauthorized access. The software complies with industry-standard regulations to ensure that all transactions are protected, affording businesses peace of mind when it comes to the confidentiality and integrity of their financial information. Additionally, SecureSpend makes it easy to generate and export detailed reports, ensuring compliance and aiding in tax preparation and audits.

Versatility is at the heart of SecureSpend Accounts Software, offering seamless integration with a variety of payment gateways and banking systems, which streamlines transaction processing and account reconciliation. The platform also incorporates a powerful analytical toolkit that offers predictive insights, helping businesses to forecast budgets and identify potential financial trends. With exemplary customer support and a suite of customisable options, SecureSpend stands out as a reliable and adaptable financial tool for businesses aiming to strengthen their fiscal management and growth.

| Feature | Description |

|---|---|

| Balance Inquiry | Call toll-free number on the back of the card or check online using the card’s 16-digit number and security code. |

| Acceptance | Can be used anywhere Visa or Mastercard is accepted, for purchasing goods or services. |

| In-store Issues | If the card is invalid, contact SecureSpend customer service for a replacement, using the original receipt for reference. |

| Cash App Compatibility | SecureSpend cards cannot be used to add funds to Cash App accounts as of February 1, 2022. |

| Customer Service Helpline | A toll-free number is available for balance inquiries and to report issues with the card usage. |

| Security Features | A 16-digit card number and security code are required to check the balance or for transactions, safeguarding against unauthorized access. |

| Convenience | Typically available for immediate use upon purchase without the need for a credit check. |

| Replacement Policy | If the card is defective or there is an issue, a replacement card may be issued with proof of purchase and the original receipt. |

Real-Life Securespend Super Savers: Success Stories

Let’s shine the spotlight on some savvy spenders who’ve mastered the art of saving with Securespend. Their stories are like a treasure map, follow ’em to riches!

Super-Saver Testimonials:

Super-Saver Tips:

The Art of Stacking Promotions with Securespend

Mix and match, baby! Stacking Securespend promos with other deals that stores offer is like a savings sundae with all the toppings.

Combining Securespend Benefits:

Examples of Successful Stacks:

Tech-Savvy Securespend: Apps and Tools for Enhanced Savings

Tech’s your pal in the saving saga. Hook Securespend up with some snazzy apps and budgeting tools, and watch your digits dance with delight.

Must-Have Apps:

Tracking Spending and Savings:

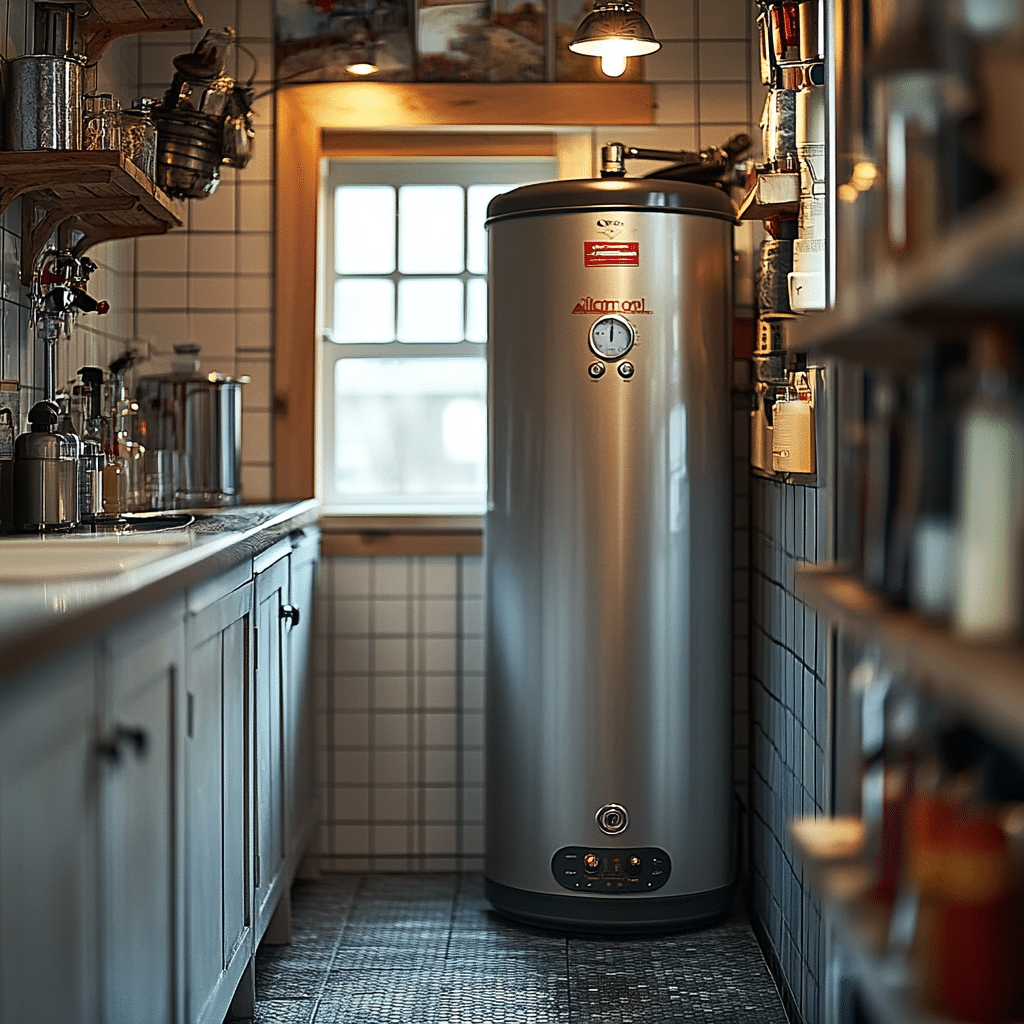

Visa $Gift Card (plus $Purchase Fee)

$206.95

The Visa $Gift Card (plus $Purchase Fee) is the perfect versatile present for any occasion, from birthdays and graduations to weddings and anniversaries. It offers the recipient the freedom to choose their ideal gift from millions of merchant locations where Visa debit cards are accepted, ensuring that your thoughtful gesture is as personal as it is convenient. The gift card is preloaded with a specific amount of money which can be used at brick-and-mortar stores, online, or over the phone, effectively transforming it into an ideal cash alternative for shopping.

Unlike store-specific gift cards, the Visa $Gift Card ensures that your gift recipient is not limited to one particular retailer or shopping platform. The gift card can be easily managed online, where the balance can be checked, and transactions reviewed, giving users a simple way to track their spending and remaining balance. The card’s sleek and professional design makes it a sophisticated gift, and for an additional personal touch, some providers offer options for customization.

Please note that the Visa $Gift Card comes with an additional purchase fee, which covers the cost of the card’s activation and maintenance. This one-time fee ensures that the card is ready to use as soon as it’s in the hands of your recipient, providing immediate access to the funds. It’s important for customers to be aware of the fee structure before purchasing to avoid any surprises. Plus, the card’s security features mirror those of a traditional Visa debit card, offering peace of mind with zero liability protection against unauthorized purchases.

Navigating Online and Brick-and-Mortar Bargains with Securespend

Whether you’re clicking through deals or cruising the aisles, Securespend flexes to fit.

Strategies for Online vs. In-Store:

Case Studies of Success:

The Hidden Perks of Securespend: Lesser-Known Benefits Explored

Like a detective novel, Securespend has twists and rewards you didn’t see coming.

Discovering Hidden Benefits:

Securespend and Subscription Services: A Match Made in Savings Heaven

Monthly boxes of joy or streaming services, pair them with Securespend, and you’re in for a treat.

Effectively Using Securespend:

Beyond Groceries: Unconventional Ways to Save with Securespend

Securespend isn’t just for stocking the pantry. It’s got the power to cut costs on pretty much everything.

Non-Traditional Savings Routes:

Maximizing Holiday Shopping with Securespend

Holidays can burn a hole in your wallet faster than a sleigh on a snowy slope. But with a bit of Securespend savvy, you’re set for savings.

Strategies for the Holiday Frenzy:

Creating a Securespend Savings Plan: Strategies and Best Practices

A stitch in time saves nine, and a Securespend plan saves even more.

Integrating Securespend into Your Budget:

Step-by-Step Savings Plan Guide:

Avoiding Pitfalls: Common Mistakes With Securespend and How to Prevent Them

Even the best fall down sometimes, but with Securespend, it’s all about shopping smarter, not harder.

Recognizing and Avoiding Errors:

Conclusion: The Securespend Path to Insane Savings

To wrap it up like the perfect gift, using Securespend is all about taking a proactive notch to your savings. It’s the golden key to spend less, save more, and still indulge in the finest perks life offers. Be the maestro of your spending symphony. Ready to get in on the action? Swing by “secure spend” and start your savings journey. You’ve got this, Savvy Spenders!

Now, go forth and conquer those insane savings!

Shop Smart with Securespend: Your Go-To Guide for Unbelievable Buys

Hey, savvy shoppers! Got your securespend card? Well, buckle up, because we’re diving into a savings spree that’ll knock your socks off! Get ready to fill up your carts with insane deals that’ll make your wallet happier than a kid in a candy store.

The Secret’s in the Card

Listen, if you’re walking around without a securespend card in your wallet, you’re practically leaving money on the table! It’s like having a magic wand that poofs prices lower the second you swipe. So, why not wield that wand and cast a spell for some serious savings?

Get a Load of These Deals

Alright, let’s talk turkey. You’re out there looking for the biggest bang for your buck, right? Well, rumor has it, some securespend shoppers have nabbed deals so wild, they had to pinch themselves to make sure they weren’t dreaming. We’re talking prices slashed left and right – truly, the stuff of legends.

It Ain’t Just Hocus Pocus

Now hold your horses, this isn’t just some tall tale. Real people with real securespend cards are stacking up the savings higher than a skyscraper. By shopping smart and keeping an eagle eye on the best deals, they’re making penny pinchers everywhere green with envy.

A Deal That’s Heaven Sent

But wait, there’s more! Did you hear about the one with the archdiocese Of baltimore? Some folks with securespend scored savings so heavenly, they almost felt like they’d been touched by an angel. That’s right, even the most divine deals are within reach when you’re paying with securespend. And if you don’t believe me, just take a gander at the archdiocese’s story.

Crazy Savings? You Bet!

Oh, and get this – I’ve heard tell of securespend shoppers who’ve saved so much moolah, they could’ve thrown their own parade. I mean, who needs a shopping cart when you could practically hire a marching band to celebrate those discounts?

No Beans About It

In a nutshell, using securespend isn’t just smart – it’s downright genius. Like finding a four-leaf clover in a field of weeds, it’s your lucky ticket to price cuts so deep, they’re practically a steal.

So there you have it – the inside scoop on how securespend can unlock a world of savings that’ll have your friends begging you to spill the beans. Just remember, keep this guide hush-hush; we wouldn’t want these insane deals getting too crowded, would we? 😉

How do I check my prepaid gift card balance?

Got a prepaid gift card burning a hole in your pocket? Checking your balance is a walk in the park! Just head to the card provider’s website or give them a quick call – the number’s usually on the back of the card. Punch in your card details, and bam! You’ll know exactly how much shopping ammo you’ve got.

Where can I use my SecureSpend card?

“Where can I use my SecureSpend card?” you ask? Well, you’re in luck! That trusty SecureSpend card can be whipped out at most places that take Visa. Online or in-store – you name it, they’ll probably take it, as long as it’s in the U.S. So go ahead, swipe away!

Why is my SecureSpend card invalid?

Why is your SecureSpend card throwing a tantrum, saying it’s invalid? Hold your horses, it might just be a hiccup. Check that the card’s activated, the details are punched in right, and that it isn’t past its prime, expiration-wise. If everything checks out, but it’s still being a diva, give their customer service a holler.

Can I add secure spend card to cash App?

Can you link your SecureSpend card to Cash App? Well, you might hit a snag there, buddy. Cash App prefers to play it safe with linked bank accounts, credit cards, and some debit cards – so a SecureSpend card might not make the cut. But hey, worth a try, right?

How do I check my gift card balance without redeeming it?

Wanna peek at your gift card balance without using it? It’s a piece of cake! Go on the card’s website or ring them up, but don’t fret – peeking doesn’t mean spending. Just make sure not to accidentally breeze through the checkout process.

Can I check if my gift card is activated?

Curious to know if your gift card’s got its game face on? Just flip that card over, and give the toll-free number or website a whirl – you’ll find out if it’s activated faster than you can say “shop ’til you drop.”

How do I check the balance on my Visa Secure Spend gift card?

Struggling to check the stash on your Visa Secure Spend gift card? No sweat – hit up their website or dial the number on the back of the card. Feed it your card details, and it’ll spill the beans on your balance.

How do I use my Securespend card online?

Alright, to use your SecureSpend card online, just treat it like any other credit card. At checkout, fill in your card info just as you would if it were a regular Visa. Just make sure the balance covers your cart, or things could get awkward.

How do I get money off my secure spend prepaid Visa card?

Want to get your paws on the cash from your Secure spend prepaid Visa card? Oof, that’s a tough cookie. You can’t draw cash from ATMs or get cash back, but you can spend it just like cash anywhere Visa is accepted!

Can you get cash back with Securespend card?

Cash back with a SecureSpend card? Afraid that’s a no-go, my friend. These cards are strictly for spending on goods and services, not for cash withdrawals. So you’ll have to keep that shopping spree on a leash.

Why is my prepaid card declining when I have money?

Prepaid card declining despite being flush with cash? Check the basics: is the card activated, right? Are the details correct? Enough funds? If it’s still being finicky, reach out to customer service – they’ll help you sort this mess out.

What if my Vanilla gift card has no CVV?

Your Vanilla gift card is missing a CVV? Take a deep breath and look closer; sometimes these pesky numbers are just hard to spot. If it’s truly playing hide and seek, reach out to Vanilla’s customer service for a little game of seek and you shall find.

Can you reload a secure spend prepaid Visa card?

Got a SecureSpend prepaid Visa and wondering if you can top it off? Sorry, but it’s a one-and-done deal. Once you’ve spent what’s on it, it’s time to say goodbye and grab a new one.

Does venmo accept prepaid cards?

Does Venmo accept prepaid cards? You betcha, in some cases at least! Venmo can be quite picky, but they do roll out the welcome mat for some prepaid cards. Just add it to your account and see if it’s in the cool club.

What prepaid card works with Zelle?

Looking to buddy up a prepaid card with Zelle? It’s hit or miss, but generally, Zelle prefers hooking up with bank accounts directly. Still, check with Zelle – sometimes they’re feeling generous and let prepaid cards join the party.

How do I check out on a gift card online?

Checking out online with a gift card? Just a hop, skip, and a jump to the finish line! At the payment page, select “Gift Card” as your payment method, type in the number and PIN, and voilà, the internet’s your oyster!

How do I check my gift card balance on Android?

Android user? Check your gift card balance on the go by downloading the card issuer’s app or visiting their website. Sign in, tap a few times, and bam – balance at your fingertips!

Do prepaid gift cards expire?

Do prepaid gift cards expire? The card says “use me or lose me!” Usually, there’s an expiration date stamped on the front or back, so keep an eye on that clock ticking – don’t let your cash get caught napping!

How do I check my Visa virtual card balance?

Looking to check your Visa virtual card balance? Just boot up your browser and stride into the issuer’s website. Log in, and you’re moments away from discovering the depths of your digital wallet. Easy-peasy!