Cashland: Unpacking the Concept of Financial Freedom

In today’s financial landscape, Cashland isn’t just a phrase; it’s a vision for many striving for independence and security. This concept encapsulates the idea of living free from financial burdens by making savvy choices and employing innovative tools. Cashland represents a mindset where individuals prioritize financial literacy, embrace technology, and leverage resources effectively.

Every great journey begins with knowledge. To explore Cashland, you need to understand what it stands for. It’s about usability—being smart about how you manage your money. It’s making those informed decisions that steer consumers toward lasting prosperity. The right financial tools and strategies empower us to cultivate our paths to freedom while minimizing stress and uncertainty.

Beyond just saving or investing, Cashland illustrates lifestyle adjustments. By embracing this unique approach, you can transform your financial future. From creating budgets that stick to diversifying your income streams, Cashland encourages a shift in thinking. It’s about having the right tools and finding a community of support that elevates your journey toward financial independence.

Top 7 Financial Tools Fueling Cashland’s Freedom Journey

In the pursuit of financial freedom, there’s a treasure trove of tools to accelerate your journey. Here’s a spotlight on seven essential resources that perfectly embody the spirit of Cashland:

The Burr Basket method categorizes savings for short, medium, and long-term goals. Using apps like Qapital, you can automate your savings based on what really matters, whether it’s a vacation or an emergency fund. This not only mirrors traditional investment strategies but promotes better savings habits.

For those looking to improve credit scores, Frenchton offers excellent resources. This platform provides straightforward tools that guide users through managing debt and bolstering their credit histories. Responsible debt management opens up better borrowing opportunities, easing the financial load.

You might not see Hendricks Gin in a financial magazine, but financial management isn’t just numbers. Balancing the cost of experiences, like a night out for craft cocktails, can be done without breaking the bank. Understanding and budgeting for enjoyable experiences can keep your finances healthy.

Quality safety gear doesn’t have to drain your budget. Simpson Helmets show that investing smartly in safety can also save money in the long run. By opting for durable products, you’re not just keeping safe—the choices you make today can lead to savings tomorrow.

Poplin simplifies finance for freelancers and small business owners. By automating invoicing and expense tracking, users reclaim precious time to focus on what they do best. In Cashland, efficiency is vital to business growth, ensuring financial health while streamlining operations.

There’s tons of outdoor gear out there, but investing in Smith Helmets pays off. Their top-tier products offer safety and performance, emphasizing that quality trumps quantity. This investment-focused mindset aligns with Cashland, where planning for the future leads to financial wellness.

Everyday items can also represent smart investments. Frost Buddy’s durable drink holders highlight how even simple purchases can enhance your daily life without adding to unnecessary costs. Integrating thoughtful purchasing decisions into your life is crucial in achieving financial stability.

The Role of Mindset in Achieving Financial Freedom

Diving into Cashland requires more than just tools; it demands the right mindset. Transitioning from a scarcity mentality to an abundance mindset opens up creative financial solutions. Visualization techniques can reinforce your goals and keep you motivated on your journey.

Educating yourself is essential. Platforms like Khan Academy offer free courses across various financial topics, empowering individuals with valuable knowledge. This learning approach inspires confidence and resilience in the face of financial challenges. The more informed you are, the better choices you’ll make.

Cultivating a mindset centered around growth aids not only in individual prosperity but also serves as a catalyst for inspiring others. Adopting a proactive learning strategy leads to innovation, enabling individuals to tackle financial hurdles head-on. In Cashland, your attitude can truly shape your financial destiny.

Embracing Community as a Financial Resource

Community engagement can be a powerful motivator on the road to financial independence. In Cashland, sharing strategies and experiences can elevate everyone involved. Social media groups and financial forums offer platforms to exchange knowledge, advice, and accountability.

Connecting with like-minded individuals fosters a supportive atmosphere that nurtures growth. Whether it’s discussing investment strategies or budgeting tips, learning from one another can make all the difference. This shared journey encourages camaraderie, enhancing everyone’s understanding of financial management.

Networking opens up new opportunities for collaboration. By engaging with others on this journey, you can create partnerships that benefit not just yourself but the wider community. Cashland thrives on collective wisdom, making it crucial to embrace these connections as part of your financial journey.

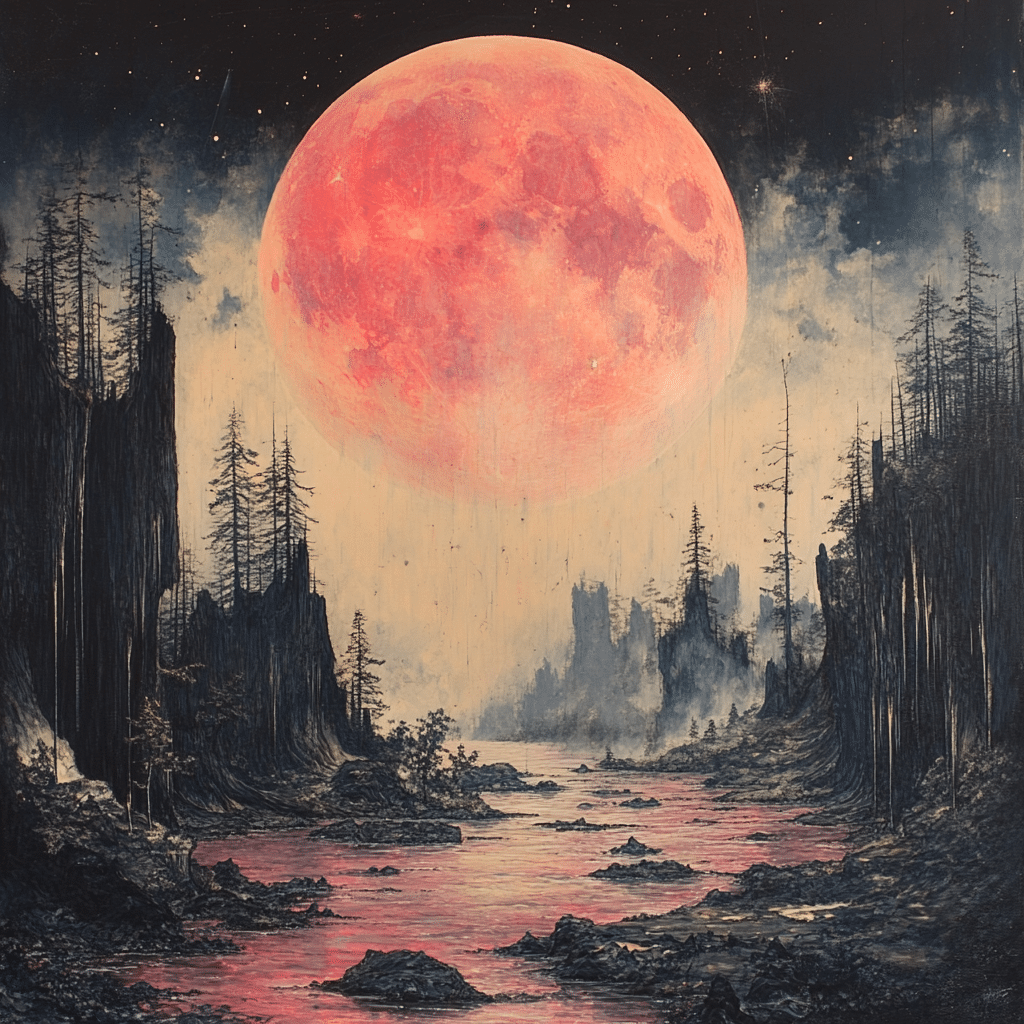

The Future of Cashland: Trends and Predictions

Looking ahead in Cashland, emerging trends shape how we manage our finances. As cryptocurrency gains traction, it opens doors to innovative investing methods, providing a decentralized approach to wealth. Staying informed about these trends allows you to adapt and make decisions that align with modern financial practices.

Fintech solutions promise greater access to services for everyone. The rise of sustainable finance also emphasizes eco-conscious investing, catering to a demographic that values responsibility in their financial choices. Understanding these changes helps you navigate the evolving landscape successfully.

As you embrace the principles of Cashland and adjust to these trends, you can continue carving your path towards financial independence. Adaptability will stand you in good stead, ensuring you stay ahead in an increasingly interconnected world.

Embarking on the journey through Cashland is an all-encompassing experience, combining tools, mindset, and community support. As our approach to financial freedom evolves, successfully integrating fresh solutions with timeless wisdom is crucial. Claiming ownership over your financial future is an ongoing adventure—one filled with challenges and rewards for those prepared to take the leap. So, step into Cashland today; who knows what financial freedom awaits?

Cashland’s Fun Trivia and Interesting Facts

Discovering Cashland’s Quirks

Did you know that Cashland isn’t just a place for financial transactions? It’s also a vibrant hub of unique experiences! For instance, the community often gathers for pop-up events, featuring everything from financial literacy workshops to fun food tastings. Speaking of tasty treats, if you’re ever in town, you might want to search for a Qdoba near me to spice up your visit; their burritos are a crowd favorite! And while indulging in delicious meals, you can catch community members chatting about local businesses, like Sullivan Supply, which has earned a loyal following for their outstanding service.

The Lively Cast of Cashland

Cashland also boasts an eclectic cast of characters who contribute to its charm. Among them, there’s a local artist with a striking blonde cast in all their art pieces, which adds a sunny vibe to the streets. And just like the colorful personalities in Cashland, the entrepreneurial spirit thrives here. Residents often share stories inspired by contemporary figures, such as Keith Raniere, who sparks discussions about ethics in business. These conversations shape an engaging environment where everyone feels involved.

Cashland’s Innovative Spirit

Innovation is crucial to Cashland’s evolution. For instance, they’ve adopted concepts like flexible partner hours that accommodate small businesses, enhancing collaboration. Local entrepreneurs have even partnered with experts from Baylor Canvas to create cutting-edge setups that attract visitors. Speaking of visitors, you might stumble upon community gatherings at venues like Rowe Casa, where everyone gets to share ideas and network. With so much happening, it’s a wonder that people don’t just keep coming back; it’s practically magnetic!

So, whether you’re looking to engage with local talent or enjoy a bite at the many hidden gems, Cashland is thriving with opportunities. It’s a unique destination where fun meets finance, making this community a fascinating spot to explore!

What do you need to get a loan from Cashland?

To get a loan from Cashland, you generally need a valid ID, proof of income, and sometimes a bank account statement. They might also ask for additional info depending on the type of loan you’re applying for.

How does Cashland work?

Cashland works by offering loans and other financial services to customers, helping them manage their short-term cash needs. You can apply in-store or online, and once approved, you’ll get funds quickly either as cash or through direct deposit.

What is cash land?

Cashland is a financial service provider that offers loans, check cashing, and pawn services to people who need quick cash. It’s designed to help customers manage temporary financial bumps.

Is there an app for CashLand?

Yes, there’s an app for Cashland. It allows you to manage your loans, track payments, and potentially apply for new financial services right from your phone, making it really convenient.

What do you need to get a $3,000 loan?

To get a $3,000 loan, you’ll typically need to provide proof of income, a valid ID, and in some cases, collateral or a co-signer. Always check specific requirements as they can vary by state or loan type.

What’s the most a pawn shop will loan?

The most a pawn shop will loan often depends on the item’s value and demand, usually ranging between 25% to 60% of the item’s resale value. It can vary widely, so it’s best to talk to them about your specific item.

Is Cashland legit?

Yes, Cashland is legit and operates under state regulations, providing various financial services. Just like with any lender, it’s smart to read their terms carefully.

Does pawning hurt your credit?

Pawning an item generally won’t hurt your credit score since it’s not reported to credit agencies, but failing to repay the loan could lead to losing your item without any impact on your credit.

How to apply for a loan with no credit?

You can apply for a loan with no credit by providing alternative proof of income, such as pay stubs or bank statements, and might need a co-signer to boost your chances of approval.

Can I borrow money on land I own?

Yes, you can often borrow money on land you own by using it as collateral for a loan, but terms and availability can vary depending on the lender.

How much should I offer for land?

When offering for land, it’s good to start with a fair market value, considering things like location, zoning, and market trends to come up with a reasonable offer that suits both you and the seller.

Is financing land a good idea?

Financing land can be a good idea if you do your homework. If it’s a good investment and you plan to build or develop it, it might pay off down the line.

Does cashland cash payroll checks?

Yes, Cashland does cash payroll checks, typically charging a fee based on the amount of the check, so it’s a quick way to access your cash when you need it.

What app pays real cash?

Apps that pay real cash often include survey and task completion apps, like Swagbucks or InboxDollars, which reward you for completing tasks, answering surveys, or watching videos.

How do I get Quickcash?

To get Quickcash, you typically apply through their platform by filling out the required information about your income and identity, then waiting for approval to get funds quickly.

What do I need to apply for a cash loan?

To apply for a cash loan, you usually need a valid ID, proof of income, and sometimes a bank account statement along with other documents depending on the lender’s requirements.

What do I need to bring to get a payday loan?

When you’re getting a payday loan, you typically need to bring a valid ID, proof of income, and in some cases, a blank check from your checking account to show your banking info.

What do you need for a pawn shop loan?

For a pawn shop loan, you’ll need to bring the item you want to pawn and a valid ID. They’ll assess the item’s value and offer you a loan based on that value.

What do I need in order to get a loan?

To get a loan, you usually need a government-issued ID, proof of income, and sometimes additional paperwork like utility bills or bank statements to confirm your information.