In the fast-paced world of commerce where the swipe of a card or a click online leads to instant gratification, secure spend practices have never been more crucial. Let’s slash through the digital jungle of false beliefs one swipe at a time and explore the truth behind some of the most common secure spend myths.

Unveiling the Truth Behind Secure Spend Practices

$astercard Gift Card (plus $Purchase Fee)

$105.95

The $astercard Gift Card is a versatile financial tool that allows recipients to enjoy the freedom to shop and access services anywhere Mastercard is accepted. This convenient gift card comes with a pre-loaded balance that can be spent in-store, online, or over the phone, making it ideal for those who appreciate flexibility and choice in their purchasing power. The $astercard Gift Card is perfect for any occasion, whether it’s a birthday, wedding, holiday, or a simple gesture of appreciation, providing a seamless and appreciated gift experience for anyone on your list.

When purchasing the $astercard Gift Card, be aware that an additional one-time $Purchase Fee is applied, covering the costs of the card’s activation and maintenance. This fee is standard among prepaid gift cards, ensuring the card is ready to use upon receipt and valid up until the expiration date, without any hidden costs or monthly charges for the user. Customers can select from various denominations to fit their gifting budget, allowing for a personalized touch to their gift-giving.

The sleek and professional design of the $astercard Gift Card makes it a sophisticated gift, reflecting the thoughtfulness and esteem you hold for the recipient. Registering the card online enables the recipient to manage the card’s balance and review transaction history, adding an extra layer of security and convenience to the cardholder’s experience. The added protection against theft or card loss ensures that your thoughtful gift remains secure and enjoyable, reinforcing the value and utility of the $astercard Gift Card as the perfect present for friends, family, or colleagues.

Myth #1: Secure Spend Systems Are Only for the Tech Elite

Hold on to your hats, folks! The idea that you’ve got to be in cahoots with the likes of Steve Jobs to navigate through the magical world of secure spend technologies is as outdated as a pager in a smartphone world. Fact is, platforms such as Apple Pay, Google Wallet, and the new kids on the block are designed for every Tom, Dick, and Harriet.

These user-friendly secure spend platforms are quite the chameleons, adapting seamlessly to their user’s tech savviness—or lack thereof. They mask the complexities behind a simple tap or a click! Indeed, experts advocate that the democratization of secure spend tech means everyone from the local baker to your grandma can now transact with the tap of a finger.

Don’t believe it? Take the Trixie Motel project, where secure spend technologies are used for souvenir purchases online. If the inventive Trixie Mattel can back it up, so can you!

Myth #2: Cryptocurrencies Are the Only Truly Secure Spend Method

Crypto enthusiasts, cover your ears; we’re about to bust another bubble. While cryptocurrencies often bask in the limelight as the Fort Knox of digital currencies, let’s not forget our steadfast pal, the chipped credit card, or the emerging blockchain-based fiat systems that are giving crypto a run for its Bitcoin.

Real-life incidents have shown us that cryptocurrencies, while packed with security features, have had their Achilles’ heels exposed. In contrast, traditional finance’s stalwarts often flaunt a less flashy but robust security record worthy of a nod. Reminder: the Spider-Man 2 film – everybody gets one; the same goes for spending platforms, so let’s not put all our secure spend eggs in one crypto basket.

Myth #3: Secure Spend Tools Compromise Personal Privacy

Here’s the kicker: more security does not translate to a free-for-all on your personal data. Contrary to popular belief, secure spend tools, particularly contactless payment methods, are like a digital Fort Knox for your privacy. They shimmy up the data protection ladder with finesse, keeping your deets under lock and key.

Let’s bring the cybersecurity experts on stage for a standing ovation. Bravo! They assure us that robust secure spend technologies are on personal information watch 24/7. Be it tap, swipe, or PIN entry; your privacy is top priority.

Retire Secure for Professors and TIAA Participants

$1.99

“Retire Secure for Professors and TIAA Participants” is an indispensable guide for educators seeking to maximize their retirement benefits through TIAA. Crafted with the specific needs of professors and academic professionals in mind, this comprehensive resource demystifies the process of planning and saving for a secure and comfortable retirement. It offers clear, expert advice on how to effectively navigate the often-complex terrain of TIAA accounts, providing strategic insights into investment options, withdrawal strategies, and tax implications. With its reader-friendly approach, the guide ensures that academic practitioners can confidently approach their golden years with a well-structured financial plan.

The book delves deeply into the unique retirement considerations facing those in the academic realm, such as managing pensions, understanding the nuances of 403(b) plans, and the potential impact of tenure on retirement timing and benefits. It includes practical tips on how to balance risk and returns, optimize asset allocation, and utilize TIAA’s annuities to create a reliable stream of retirement income. Additionally, it tackles the tricky aspects of estate planning and health care in retirement, ensuring readers are prepared for all aspects of their post-working life. By focusing on the specific scenarios that professors and TIAA participants face, the book provides targeted guidance that can’t be found in more general retirement planning literature.

“Retire Secure for Professors and TIAA Participants” isn’t just a dry financial manual; it’s a roadmap for achieving peace of mind in retirement, tailored to the educational community. The author’s deep understanding of the academic environment shines through, as does the commitment to helping educators reap the full benefits of their lifetime’s work and contributions to society. The guide is peppered with real-life examples, case studies, and actionable steps that bring the retirement planning process to life. Whether nearing retirement or decades away, this essential guide empowers professors to make informed decisions, secure in the knowledge that their retirement planning is on a solid foundation.

Myth #4: Using Secure Spend Solutions Always Costs More

“High security, high cost” – said no one ever who looked at the books! Businesses sporting secure spend practices often find their ledger grinning thanks to the cost savings. When transactions are armour-plated against fraud, it’s like swapping a leaky bucket for a secure vault.

Take, for instance, the cost of a data breach versus the upfront investment in secure spend-options. Spoiler alert: prevention beats cure. Just ask businesses that have made the leap; they’ll have tales worth their weight in saved dollars.

Myth #5: Secure Spend Platforms Are Infallible

Let’s get real here; nothing’s bulletproof, and secure spend platforms are no exception. Like The Rock And Kevin harts dynamic, even the strongest partnerships have vulnerabilities. However, it’s not about being invincible; it’s about resilience.

History has schooled us with tales of secure spend platform breaches, but the sage takeaway here is the evolution of safeguard measures. Today’s secure spend platforms are akin to digital phoenixes, rising stronger from the ashes of past breaches.

Myth #6: Transitioning to Secure Spend Options Is Overwhelmingly Complex

The mere thought of transitioning to secure spend methods sends shivers down the spines of individuals and business owners alike. But hold your horses! It’s not the Herculean task some make it out to be.

Picture this: a piecemeal transition, clear guidelines, and a support system as robust as a WWE tag team—all of which make the switch smoother than a How To Rizz up a girl guide. Plus, the beaming faces of those who’ve smashed through the transition barrier tell a tale of a process less daunting than you might think.

Myth #7: Secure Spend Technology Will Soon Be Obsolete

What’s that on the horizon? Naysayers prophesizing the demise of secure spend tech? Don’t bet on it. Secure spend isn’t just a flash in the payment pan; it’s stapled into the fabric of our digital transactions, future-proofed and ready to tango with whatever innovation throws its way.

Peek into the innovation lab of secure spend technology, and you’ll find fintech leaders bubbling with excitement. Securespend is not just sticking around; it is dancing into the future, two steps ahead of the game!

Pushing Past the Secure Spend Hype: A Deeper Dive

Take a step off the hype train and stroll through the world of secure spend technologies with an investigative lens. This isn’t about taking a peek; it’s about a deep dive into emerging trends that mold the future.

There’s a whirlwind of development in this sector, and it plays a pivotal role. From the backend systems securing your transactions to the seamless checkout experience, we’re not just scratching the surface – we’re unearthing the gold mines of innovation and security.

Instant HEPA Quiet Air Purifier, From the Makers of Instant Pot with Plasma Ion Technology for Rooms up to ft; removes % of Dust, Smoke, Odors, Pollen & Pet Hair, for Bedrooms

$91.75

Experience the next-level air purification with the Instant HEPA Quiet Air Purifier, designed by the innovators of the Instant Pot. This revolutionary air purifier combines high-efficiency particulate air (HEPA) filtration with advanced Plasma Ion Technology to create an impeccable home environment. Perfect for spaces up to ft, it captures an impressive % of airborne particles, including dust, smoke, odors, pollen, and pet hair. This powerful yet quiet air purifier ensures a cleaner, fresher atmosphere in your bedrooms and offices without any disruptive noise.

The sleek Pearl model not only purifies your air but also enhances the aesthetics of your space with its modern and elegant design. The user-friendly interface allows for intuitive control, with multiple fan speeds that adjust to your purification needs. Furthermore, the purifier’s smart filter replacement indicators ensure optimal performance by alerting you when it’s time for a new filter. Its compact size and silent operation make it an ideal choice for both personal and office spaces, offering peace of mind and comfort.

Safety and efficiency are at the core of the Instant HEPA Quiet Air Purifier’s design. The Plasma Ion Technology projects positive and negative ions into the air, clumping fine particles together to be captured more effectively while also combatting airborne bacteria and viruses. This technology, combined with true HEPA filtration, delivers a cleaner and healthier indoor environment. Rest easy knowing this trusted brand is working tirelessly to improve the air quality around you, ensuring that you and your loved ones can breathe easy 24/7.

| Factor | Details |

|---|---|

| Checking Balance | – Call the toll-free number on the back of the card. – Visit the issuer’s website and enter the 16-digit card number and security code. |

| Usage | – Can be used to obtain goods and services where Visa or Mastercard is honored. – Applies to both physical cards and virtual accounts. |

| Card Details Verification | – Ensure correct entry of the card number, expiration date, and security code. – Mistakes in entering information can result in the card being flagged as invalid. |

| Security Features | – A 16-digit unique card number for transaction identification. – A security code (CVV) to verify card authenticity during online or phone transactions. |

| Limitations and Considerations | – Gift cards may have expiration dates. – Some cards may have fees for inactivity or maintenance. – Usage might be limited to certain merchants or types of purchases depending on the card issuer’s terms and conditions. |

| Date of Information Update | – The given process for verification and problem resolution is as of December 13, 2022. Future changes to card issuer’s procedures or terms may not be reflected. |

Conclusion: The Enlightened Approach to Secure Spend

Our expedition through the secure spend minefield has been quite the odyssey—eye-opening, to say the least. We’ve debunked myths, called out the bluff on misconceptions, and now stand more informed and discerning in our approach to secure spend technologies.

Remember, knowledge is the new currency, and staying ahead of the curve is the hallmark of the enlightened spender. As we bid adieu, let’s tip our hats to the vibrant future of secure spend. The call to action? Engage, educate, and empower yourself to embrace the secure spend revolution with open arms and a savvy mind.

Cracking the Vault on Secure Spend Myths

Buckle up, dear readers, ’cause we’re about to bust some myths about “secure spend” that have been floating around like loose change in a laundromat. You’ll wanna hang onto your hats for this wild ride!

The “Totally Hack-Proof” Fairytale

Let’s kick things off with a whopper that would make Pinocchio’s nose grow. Some folks believe that secure spend systems are impregnable fortresses, but hey, even the Elaine A. Zane of cybersecurity wisdom warns us that no system is 100% hack-proof. It’s like expecting spiders to stop climbing walls after watching “Spider-Man 2”; these little critters—hackers, not spiders—always find a way!

The “Empty Wallet Ghost” Story

Next up on the myth parade is the eerie tale that goes, “Use secure spend methods and watch your money vanish into thin air!” Well, that’s about as true as a unicorn’s weekend plans. Sure, technology glitches can happen, like when your favorite superhero movie’s release date gets pushed back, but secure spend platforms are your vigilantes in the night, guarding your cash with their digital superpowers.

The “One-Size-Fits-All” Yarn

Alright, onto the next tall tale—and this one’s got more holes in it than a punch needle project gone wrong. Some believe that one secure spend method suits everybody, but let’s face it, we’re all different! Secure spend has as many flavors as your local ice cream shop. Picking the right one is like matching your belt to your shoes; it’s all about what works best for you.

The “Criminals-Be-Gone” Chant

Oh, and then there’s the mythical incantation: “Adopt secure spend, and poof! Criminals flee!” Now, if that were true, security experts would be out of jobs faster than Young Thug drops a new track. Secure spend tools are like having a bouncer at your financial party—they’ll show troublemakers the door, but sometimes a determined gatecrasher slips through.

The “Invisible Fees” Haunt

We’ve got a bone to pick with the spooky story of hidden fees lurking in your secure spend statement. Hey, we’re all afraid of surprises when it comes to money, but like checking under the bed for monsters, a little due diligence dispels this fear. Secure spend isn’t a haunted house; it’s more transparent than you think!

The “Too-Complicated” Conundrum

Oh, and then comes the head-scratching myth, “Secure spend is more complex than rocket science!” Okay, let’s not get tangled up in this misconception. Sure, it might seem like learning a new language at first, but with a nudge in the right direction, you’ll be navigating secure spend as smoothly as a skateboarder on a half-pipe.

The “Change-Averse” Antiquated Adage

Lastly, we’ve got the old-timer’s yarn that goes, “Secure spend is for the young, tech-savvy whippersnappers!” Well, that’s about as dated as a flip phone. We promise you, secure spend isn’t an exclusive club for the young ‘uns. Like a timeless classic tune, it resonates with folks from all walks of life.

So there you have it, friends—seven secure spend myths sent packing! Just remember, when it comes to managing your moola, don’t believe everything you hear, and always do your homework. Stay savvy, stay secure, and keep counting those digital dollars!

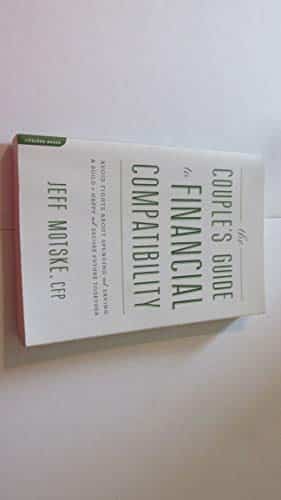

The Couple’s Guide to Financial Compatibility Avoid Fights about Spending and Saving and Build a Happy and Secure Future Together

$12.34

“The Couple’s Guide to Financial Compatibility” is an essential resource for partners looking to strengthen their financial bonds and build a secure future together. This insightful guide tackles the often-contentious issue of money, which can be a source of significant tension in relationships. It provides couples with practical strategies and tools to understand each other’s spending habits, savings goals, and economic values, emphasizing the importance of communication and mutual respect. By reading this book, couples will learn how to navigate financial disagreements and make informed decisions that benefit both partners.

With expert advice drawn from the real-life experiences of financial planners and successful couples, this guide outlines a step-by-step approach to achieving financial harmony. It addresses topics such as budgeting together, managing debt, and planning for major life events, from buying a house to saving for retirement or planning a dream vacation. Couples will discover how to set shared financial goals and create a tailored plan that accommodates both individual needs and collective aspirations. The book also addresses delicate issues like what to do if one partner is a spender and the other a saver, offering actionable advice to find common ground.

Beyond just preventing fights about money, “The Couple’s Guide to Financial Compatibility” helps partners to cultivate a deeper understanding and appreciation of one another’s approach to finances. This, in turn, enhances the overall quality of the relationship by promoting a sense of teamwork and partnership. By applying the principles laid out in this guide, couples will not only improve their financial situation but also reinforce the foundation of their relationship, paving the way for a happier and more prosperous future together. It is an invaluable manual for any couple that wishes to turn their financial journey from a potential battlefield into a collaborative, rewarding endeavor.

How do I check the balance on my Visa Secure Spend gift card?

Wanna know how much you’ve got left on that Visa Secure Spend gift card? Easy-peasy! Just hop online and head to their website or give them a quick ring using the number on the back of your card. Oh, and don’t forget, sometimes they print it on the receipt too!

Where can I use a secure spend gift card?

Looking for places to splash some cash with your Secure Spend gift card? You’re in luck! Use it anywhere Visa’s accepted, which is pretty much everywhere, from your favorite online shops to the corner store. Just swipe and go!

How do I check my prepaid card balance?

To check your prepaid card balance, just look on the back of the card for a website or phone number. A quick call or a short online trip later, and voila! You’ll know exactly how much dough you’ve got to spend.

Why does my secure spend card not work?

Got a Secure Spend card that won’t play ball? Yikes! It could be for all sorts of reasons, like it not being activated, the merchant not accepting it, or maybe you’ve hit the spending limit. Best bet? Check their FAQ or ring customer service for the lowdown.

Why can’t I check my Visa gift card balance?

Can’t peek at your Visa gift card balance? Frustrating, right? It might be a glitch, or maybe there’s an issue with the card or website. Double-check you’re entering the details right and if it’s still a no-go, customer service should be your next stop.

How do I check my gift card balance without redeeming it?

Curious about your gift card balance but don’t wanna use it up just yet? No sweat! Leave the redeeming for later and just hit up their website or call customer support. They’ll hook you up with the info without deducting a dime.

How do I use my Visa Secure Spend gift card?

Ready to start spending with your Visa Secure Spend gift card? Just treat it like any other Visa card. Swipe or punch in those numbers at checkout, and boom, you’re golden. Keep an eye on the balance, so you don’t try spending more than what’s on the card, though.

Can I add secure spend card to cash App?

Wondering if you can add your Secure Spend card to Cash App? Ah, that’s a tricky one. Cash App typically goes with bank-issued cards, so you might be out of luck. But hey, no harm in trying, right? Just remember, the app will give you a thumbs-up or down.

How do I get money off my secure spend prepaid Visa card?

Looking to get cold hard cash from your Secure Spend prepaid Visa card? Not so fast – these cards are usually a no-go for withdrawing cash. Your best bet is to spend it on goods or services, or you might get creative and sell it to a buddy.

How do I check my card status?

If you’re scratching your head about the status of your card, just grab that card and track down either the website or customer service number. A quick check there, and you’ll know if your card’s ready to roll or snoozing in limbo.

How do I transfer money from a gift card to my bank account?

Transferring money from a gift card to your bank account? It’s not exactly a walk in the park, but there are ways. Look for third-party services that can do the trick, but watch out for fees. Alternatively, buy yourself a money order and deposit it – old school but effective.

Why is my Visa gift card being declined when I have money?

Visa gift card giving you the silent treatment at the checkout even though it’s got cash? Ouch. It could be anything from an incorrect PIN, to the card not being activated, or maybe the purchase is more than the balance. Do a quick double-check and if there’s still trouble, customer service is your friend.

Can you reload a secure spend prepaid Visa card?

Dreaming of topping up your Secure Spend prepaid Visa card? Hold your horses, buddy. These cards are typically a one-time deal – when it’s spent, it’s spent. Plan ahead and make the most of what you’ve got!

Can you get cash back with Securespend card?

Cash back with a Securespend card, you ask? Well, that’s like trying to squeeze water from a stone. These gift cards are meant for purchases, so you’re better off using it to buy what you need rather than chasing cash.

How do I know if my Visa gift card is activated?

Eager to hit the shops with your Visa gift card but not sure if it’s ready for action? Keep calm and check for an activation sticker on the card or try a balance check online or by phone. No luck? Reach out to customer service – they’ll set you straight.

How do I use my Visa Secure Spend gift card?

Go ahead and treat your Visa Secure Spend gift card like any other Visa at checkout. Swipe, sign, or tap if it’s contactless, and off you go. Just ensure you’re aware of how much is on it to avoid an awkward “card declined” dance.

Can I add secure spend card to cash App?

Wondering again about linking your Secure Spend card to Cash App? Well, it’s like shooting for the moon – possible but tricky. Note that Cash App is choosy with cards. Try it, but don’t count your chickens before they hatch.

Can you reload a secure spend prepaid Visa card?

Wishing for a refill on your Secure Spend prepaid Visa card? Alas, it’s a one-hit wonder, no encores. Once you’ve used it, it’s time to say goodbye and snag yourself a new one for future spending.

Why is my Visa gift card being declined when I have money?

Is your Visa gift card playing hard to get at the checkout even though it’s loaded? Could be a pesky PIN issue, or it might not be activated. Make sure everything’s correct, and if it still gives you the cold shoulder, ring up customer service for the rescue.