Decoding the W-9 Form: A Comprehensive Primer for Tax Payers

Roll up those sleeves, folks—it’s time to tackle the ins and outs of that ever-so-crucial document, the W-9 form. You know, the one that doesn’t shy away from saying, “Hey, I need to get the lowdown on who you are and what you’re about tax-wise.” But why should you give two hoots about a form? Well, let me paint the picture: the W-9 form is the unsung hero that keeps Uncle Sam informed and your business running smoother than a clean juice blend.

A little bit of history: the W-9 form was concocted to make sure businesses weren’t left scratching their heads when tax season rolled around, wondering who the heck they paid and how much. It’s like a beacon, leading the tax man safely to shore.

Who needs to buddy up with this form? If you’re self-employed, a freelancer, an independent contractor, or a consultant, the W-9 form is probably as familiar to you as the back of your hand. Any time you haul in $600 or more from a gig, it’s time to introduce your client to your W-9.

The W-9 Form Unveiled: Anatomy of a Taxpayer’s Crucial Document

Diving deep into the DNA of the W-9, it’s not rocket science, but there’s more than meets the eye:

Now, comparing the W-9 with its siblings—the W-4 or the 1099—is like comparing the Btk killer suspense with a light-hearted sitcom—they’re just not the same. Each form plays its unique part in the tax game.

Office Depot Brand Double Window Self Seal Envelopes for Employees Tax Forms, x , White, Pack of Envelopes

$2.66

The Office Depot Brand Double Window Self-Seal Envelopes are an essential tool for any business or HR department during tax season. Precisely designed to fit a variety of employee tax forms, such as W-2s or 1099s, these envelopes measure ‘x’ inches, ensuring that important documents are kept secure and presentable without the need to fold them. The pack contains a generous supply of white envelopes, providing ample stock for even large businesses during the busy tax-filing period.

Incorporating a double-window design, these envelopes save time and minimize the potential for errors, as they display both the recipient’s address and the sender’s return address through clear, strategically placed openings. This feature not only streamlines the mailing process but also conveys a professional image, instilling confidence that sensitive information is handled with care. The transparent windows are positioned to align with standard tax form address fields, making these envelopes universally compatible and convenient.

To further enhance security and efficiency, these Office Depot envelopes include a self-seal adhesive strip. This means no more licking or using a separate adhesive, reducing the time spent preparing mailings and enhancing hygiene, especially important when handling large volumes of sensitive documents. Simply peel off the protective strip, press to seal, and the envelopes are mail-ready, safeguarding your employees’ private information with a strong seal that resists tampering and ensures privacy.

(Note: For a real product, specific dimensions would replace the placeholder ‘x’, and the exact number of envelopes in the pack would replace “Pack of Envelopes.” Adjust the text to include these specifics for accuracy.)

| Section | Description |

|---|---|

| Official Name | IRS Form W-9, Request for Taxpayer Identification Number and Certification |

| Purpose | To provide taxpayer identification information for income received through freelance or independent contract work. |

| Who Must File | Freelancers, independent contractors, and self-employed individuals who have earned over $600 in a calendar year. |

| Key Information Required | Name, address, tax identification number (SSN, ITIN, or EIN), federal tax classification. |

| Usage | Information on the W-9 is used by businesses to prepare 1099 forms, which report non-employee compensation to the IRS. |

| New Feature (as of Oct 2023) | Line 3b added for flow-through entities to indicate direct or indirect foreign partners, owners, or beneficiaries. |

| When to Complete | Upon request by the individual or entity paying for services that meet the IRS criteria for reporting purposes. |

| Price | Free to download and complete; provided by the IRS on their official website. |

| Benefits | Ensures compliance with tax reporting requirements; necessary for accurate tax filings and avoiding withholding issues. |

| Important Dates | Form revision on October 2023; tax information is generally required yearly or upon commencing new contract work. |

| Compliance Considerations | Failing to provide a completed W-9 when requested can result in backup withholding and potential penalties. |

Navigating the Complex Terrain of W-9 Form Compliance

Compliance isn’t just a fancy word; it’s a must-do. Especially when non-compliance is about as appealing as a day-old latte. Flub your W-9, and you’re staring down the barrel of fines and side-eye from the IRS. The responsibility sits firmly on your shoulders, especially for the self-employed.

Guess what? The law doesn’t wear kid gloves. Get your W-9 form details wrong, and it’s on you, cupcakes. That’s why it’s crucial to understand the legal intricacies tied up with your W-9. Dot those i’s and cross those t’s.

The W-9 Form in the Digital Age: E-filing and Electronic Submissions

Speaking of the times, the boom of the digital age has zapped the W-9 form into the 21st century faster than you can memorize the star Wars Movies in order.” The IRS now welcomes electronic submissions with open arms. No more snail mail, folks—this train is moving fast!

But hold on, what about keeping your digits safe? Cyber thugs would love to get their virtual mitts on your info. Fear not! Security has also leveled up, making sure your W-9 form is as safe as your love for Starbucks cup Sizes—unbreachable.

Special Circumstances: When the W-9 Form Goes Beyond the Norm

Sometimes, the W-9 form gets a call to action like it’s the lead in an action flick. Think real estate transactions or the moment you realize your debt is canceled. That’s when this form steps out of the shadows and says, “I got this.”

Whether you’re dealing with unusual baklava sales or a sudden influx of cash from a long-lost relative, the W-9 form makes sure Uncle Sam gets his piece of the pie.

Redragon Wireless Gaming Mouse, DPI WiredWireless Gamer Mouse wRapid Fire Key, acro Buttons, Hour Durable Power Capacity and RGB Backlight for PCMacLaptop, White

$46.99

Introducing the ultimate gaming weapon â the Redragon Wireless Gaming Mouse, a versatile and high-performance device made to elevate your gameplay to the next level on any PC, Mac, or laptop. This sleek white mouse offers the freedom of wireless connectivity without sacrificing responsiveness, thanks to its advanced DPI settings and rapid fire key, allowing you to adjust your precision on-the-fly and execute commands at lightning speed. With the additional macro buttons, you can seamlessly assign and activate complex sequences with just a click, giving you an edge in competitive environments.

The Redragon gaming mouse is engineered to ensure uninterrupted gaming sessions, boasting an impressive power capacity that can endure for hours of continuous use. No need to worry about running out of juice during those critical gaming moments. Its convenient wired option ensures that you can keep playing while your mouse is charging, so the game never stops.

The mouse isn’t just about functionality; it’s also about making a statement with its dynamic RGB backlighting. Customize the aesthetic to fit your setup or match your mood, with a variety of lighting effects that brilliantly illuminate the distinctive design. Durably constructed, this gaming mouse is built to withstand the rigors of intense gaming and maintain peak performance throughout your longest battles.

Case Studies: The W-9 Form at Work

Real talk: Not all W-9 tales have happy endings. There are those who’ve tripped and fallen on the way to tax nirvana. But those folks also learned a thing or two. Take Jeremy from Ssactivewear; he once flubbed his TIN. Now, he’s a W-9 wizard. Through real-life examples, we can uncover the pitfalls and power plays of the W-9 world.

When you hear these heart-to-hearts, it’s like your business soul is getting a pep talk. You too can steer clear of W-9 woes and glide through tax season.

The W-9 Form’s Influence on Tax Season Preparations

Nail that W-9, and you’re setting yourself up for a stress-free tax season that’s smoother than a festive cocktail mix. It’s simple, really. Keep your W-9 form facts straight and on time, and you’re in the clear.

Strategize to keep your records tidy and your mind at ease. Cause when tax time hits, you’ll have all your ducks in a row, or in this case, all your forms in a file.

The Future of the W-9 Form in an Evolving Tax Landscape

The only thing constant is change, and the W-9 form is not immune. With legislators itching to change up the tax scene, we need to stay on our toes. Though we can’t predict the future, we’re pretty darn sure the W-9 form will evolve to meet whatever the tax world throws at us.

As taxpayers and pros in the biz, our feedback could shape the W-9 of tomorrow—just like how we dictate fashion or the next unicorn startup.

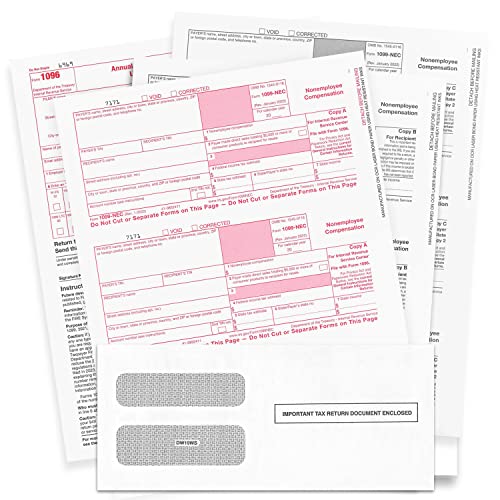

NextDayLabels NEC Forms for , Part Tax Forms, Vendor Kit of Laser Forms and Self Seal Envelopes, Forms Designed for QuickBooks and Other Accounting Software

$19.99

The NextDayLabels NEC Forms for 1099-NEC Part Tax Forms Vendor Kit offers an all-in-one solution for businesses that process nonemployee compensation. Each kit includes a complete set of laser forms along with self-sealing envelopes for a professional and efficient tax filing experience. The forms are specifically designed to be compatible with QuickBooks, among other popular accounting software, making the process of printing and mailing compensation forms seamless and error-free.

The package boasts high-quality paper stock ensuring each form maintains its integrity from print to delivery. The laser forms align perfectly with your printer settings to produce clear and legible text, which minimizes the risk of errors that could occur with manual entry or misaligned prints. The self-seal envelopes included in the kit enhance security and save precious time, thanks to their convenient peel-and-stick closure that requires no moisture.

Optimized for user convenience, the NextDayLabels Vendor Kit has been carefully crafted to meet IRS specifications, reducing the stress of compliance during tax season. Users can trust that their reporting will be accurate and professional, fostering confidence among their 1099-NEC recipients. With this comprehensive package, businesses can streamline their end-of-year reporting, ensuring all nonemployee compensation is documented properly and sent out promptly.

Mastering the W-9 Form: Essential Resources and Tools for Taxpayers

Now for the juice—and no, not the lemonade stand kind. We’re serving up a tall glass of resources and tools to get tight with your W-9. From webinars to software that’s more intuitive than a chess-playing robot, there’s a treasure trove out there for those hungry for more knowledge.

Getting savvy with your W-9 form doesn’t have to be a grind. It can be as enriching as any business venture you’re passionate about.

Bringing Clarity to Complexity: A Recap of W-9 Form Mastery

Let’s land this plane and bring it home. The W-9 form is your ticket to keeping things legit in the cash flow department. We’ve dived deep into its nooks and crannies, from history to digital do’s and don’ts, from penalty pitfalls to compliance triumphs.

As we call it a day, remember, the W-9 might be one piece of paper, but it’s packed with enough punch to make or break tax time. So, let’s keep it front and center, give it the respect it deserves, and together, sail into a future where tax troubles are just old tales. Now, go forth and show that W-9 who’s boss!

W-9 Form Fun Facts & Trivia!

Hold onto your hats, folks, because we’re diving into the wild world of tax forms. Now, before you yawn and click away, let’s spice things up with some nuggets of trivia about that little ol’ form known as the W-9. Who said taxes couldn’t be fun?

What’s in a Name?

Ever wondered why this form couldn’t just be called “Request for Taxpayer Identification Form”? Well, let’s be real – it doesn’t exactly roll off the tongue. “W-9” is short, snappy, and way easier to remember. But if you’re just itching to know what the “W” stands for, it’s part of a series of forms with the “W” prefix that relate to withholding. So next time someone asks you, you can tell them with a twinkle in your eye, “Oh, the ‘W’? It stands for withholding, of course!”

An Unsung Hero of the Freelance World

Alright, listen up, all you freelancers, independent contractors, and self-employed dynamos – the W-9 form is your new best friend! You might not realize it now, but when it’s time to get your tax affairs in order, this little form is what tells your clients, “Hey, I’m legit, and I pay my taxes!” So, go on, give it a pat. It’s more than just a form; it’s your professional badge of honor.

The Old Switcheroo

So, you thought tax forms were set in stone? Think again! Did you know the W-9 form has undergone a makeover in the past? That’s right! You can say bye-bye to the labyrinth of lines that once was, and hello to a sleeker, more streamlined form. Don’t believe me? Check out the refreshing simplicity of the W-9 form for yourself, and you’ll see that tax documentation can be, dare I say, pleasing to the eye!

A Global Reach

Let’s take a trip outside U.S. borders for a second. If you’re a foreign person who’s banking on some income stateside, you might think the W-9 isn’t for you. But hold your horses; there’s a whole other form called the W-8BEN, designed especially for the non-U.S. residents among us. This form serves as a “Declaration of Foreign Status”, which basically says, “I’m earning here, but I hail from afar.” It’s like the international cousin of the W-9 – a little different but still part of the family.

Numbers Never Lie… Or Do They?

Here’s a fun fact for you number crunchers out there: when providing your Taxpayer Identification Number (TIN) on your W-9, you might think it’s all about the Social Security Number (SSN), but you’ve got options, my friend! For the independently wealthy or the small business proprietor, an Employer Identification Number (EIN) works just as well. And for those in-betweeners, an Individual Taxpayer Identification Number (ITIN) is your ticket to tax time tranquility. Variety is the spice of life, even with tax forms!

It’s Not Hoarding if It’s Important, Right?

Last nugget for today: the W-9 is a bit of a homebody. Unlike many other tax forms that you dutifully send off to the IRS, the W-9 likes to hang out with the person or company that requested it from you. That’s right; it’s not submitted to the IRS with your tax return. Instead, it’s retained by the requester to ensure they have the correct info to report any payments made to you. So, cherish your W-9 – it’s the form that sticks around.

And there you have it! Who knew tax forms could be such a hoot? Now go out there and tackle that W-9 with the confidence of a trivia champ and the know-how of a tax pro. Happy filing!

x Envelopes for Forms in lb. White wSecurity Tint for Mailing Tax Forms, Financial Documents, Checks, Pack (White)

$15.95

The x Envelopes for Forms in lb. White with Security Tint are specifically designed for mailing sensitive documents such as tax forms, financial statements, and personal checks. Constructed from a durable lb. white paper stock, these envelopes provide a substantial feel and offer an extra layer of privacy and protection for your confidential papers. The interior of each envelope features a security tint that prevents the contents from being seen through the envelope, ensuring your information stays secure from prying eyes. The dimensions of these envelopes accommodate standard forms and documents, making them a versatile choice for both personal and professional use.

These envelopes come with a self-adhesive strip that quickly seals the envelope without the need for water or moisture, saving time and making the sealing process clean and efficient. The professional white exterior of these envelopes presents a neat and tidy image, suitable for all types of correspondence. To add an extra level of convenience, the envelopes are packaged in a pack, providing an ample supply for bulk mailings or frequent use throughout the tax season or financial quarterly reporting periods.

Ideal for accountants, tax preparers, small businesses, or anyone handling private documents, the x Envelopes for Forms in lb. White with Security Tint are a reliable mailing solution. The opacity of the security tint, combined with the sturdy weight of the paper, ensures that your documents arrive intact and unread by unauthorized individuals. Their ease of use and professional appearance make them a staple for any secure document mailing needs. With a pack of these envelopes, you can rest assured that your sensitive materials are well-protected throughout the mailing process.

What is the W-9 form used for?

Oh, the W-9 form? It’s like your financial fingerprint for Uncle Sam. It’s used to give your tax ID number to folks who pay you, ensuring they’ve got the deets to report income paid to you to the IRS. Yep, nobody’s getting lost in the IRS shuffle!

Who is the W-9 form for?

Well now, the W-9 form is kind of like a VIP pass, but for financial info. It’s for U.S. persons, which includes individuals and entities like freelancers, contractors, and vendors, to provide their taxpayer ID number to folks who shell out their cash.

What is the new W9 form for 2023?

The new W9 form for 2023, huh? Here’s the scoop – it’s like the latest model of a car but for tax forms. It’s refreshed with current info for taxpayers. So don’t get caught using last year’s model; grab the new one to stay up-to-date.

Why do I have to provide a W9?

Why you’ve gotta fork over a W9, you ask? Well, it’s simple – if you’re sucking up payments for services rendered, it’s your ticket to Tax Town. The payer needs it to report what they’ve paid you correctly. No W-9, no accurate tax records. It’s a no-brainer, really.

Do employees need to fill out a w9?

Do employees need to fill out a W9? Nah, that’s not their jam. Employees typically cozy up with a different form, the W-4. That’s their bread and butter when it comes to withholding taxes, not the W-9.

Do I have to pay taxes if I fill out a w9?

Filling out a W9 doesn’t mean taxes vanish – wishful thinking! It’s actually just your way of saying, “Here’s my tax ID, go ahead and report what you pay me.” Paying tax on that income? That’s still on your to-do list.

Who sends me a W9?

Who sends me a W9, you ask? Keep an eye out – it’s the person or business whipping out their checkbook to pay you for services. They’ll toss you a W9 to make sure the IRS gets wind of what you’re pocketing.

Who pays taxes on W9?

And who’s coughing up the taxes on a W9? Drumroll, please… it’s you, the person bringing in the dough. The form’s just a heads-up to the payer; it won’t do the dirty work of actually paying any taxes for you.

Does my employer give me a W9?

Does your boss hand you a W9? Nope, that’s not in their playbook. Only independent contractors or freelancers get that pass from clients or companies they work for. Employees snuggle up with a W-4 instead.

Do you need a W-9 from every vendor?

A W-9 from every vendor – is it a must? Well, if you’re coughing up more than $600 a year to them, then yeah, you’ll wanna play it safe and grab a W-9. It’s like your insurance against the taxman’s side-eye.

What is the penalty for not providing a W9?

Not handing over a W9? Ouch, that could sting! You could be staring down the barrel of backup withholding, where the payer has to hold back part of your pay for the IRS. Let’s just say nobody wants that surprise.

How long is a W-9 good for?

How long is a W-9 good for, you wonder? Here’s the kicker – it doesn’t have an official expiration date. But if your details change, like a name switcheroo or a new tax ID, you’ll need to fill out a fresh one.

Why would a customer ask me for a W9?

Why would a customer ask for a W9? Well, it’s not a pop quiz; they just need to know who you are, tax-wise. Think of it as their way to prove to Uncle Sam that they’re not just stuffing cash under a mattress.

What is the difference between a 1099 and a W9?

What’s the difference between a 1099 and a W9? Here’s the lowdown: a W-9 is your “Hello, here I am!” to the payer, with your tax ID. A 1099 is the payer yelling back, “Gotcha, and here’s what I paid you!” to the IRS.

Is a W-9 the same as a 1099?

Is a W-9 the same as a 1099? No siree, that’s comparing apples and oranges. W-9 is where you spill your tax info, and the 1099 is the payer’s report card to the IRS on what they paid you.

What is the difference between a w9 and a W-2?

W9 and W-2, are they twinsies? Not even close! A W9 says “I’m an independent contractor,” while a W-2 screams “Employee onboard!”

What is the difference between a 1099 and a w9?

vs. W9, what gives? The 1099 is the tell-all the payer sends to both you and the IRS on what you were paid. The W9 is just you whispering your tax ID to the payer.

Is it safe to fill out a w9?

You’re wondering if it’s safe to fill out a W9. Well, it’s as safe as locking your door at night – but only if you’re giving it to legit payers you trust. Like mom always said, don’t give your deets to strangers!

What is the difference between a w9 and an i9?

W9 and I9, siblings or distant cousins? Think of it this way: the W9 is your money buddy, telling payers your tax info. The I9? That’s all about proving you have the green light to work in the U.S. They’re playing in different leagues!